TRX Price Prediction: Technical Breakout Potential Amid Growing Ecosystem Strength

#TRX

- Technical Breakout Potential: TRX trading above 20-day MA with MACD suggesting potential bullish momentum shift

- Strategic Partnership Value: LayerZero integration and PYUSD expansion creating fundamental strength

- Market Tailwinds: Post-Fed rate cut environment supporting broader crypto asset appreciation

TRX Price Prediction

TRX Technical Analysis: Bullish Momentum Building Above Key Moving Average

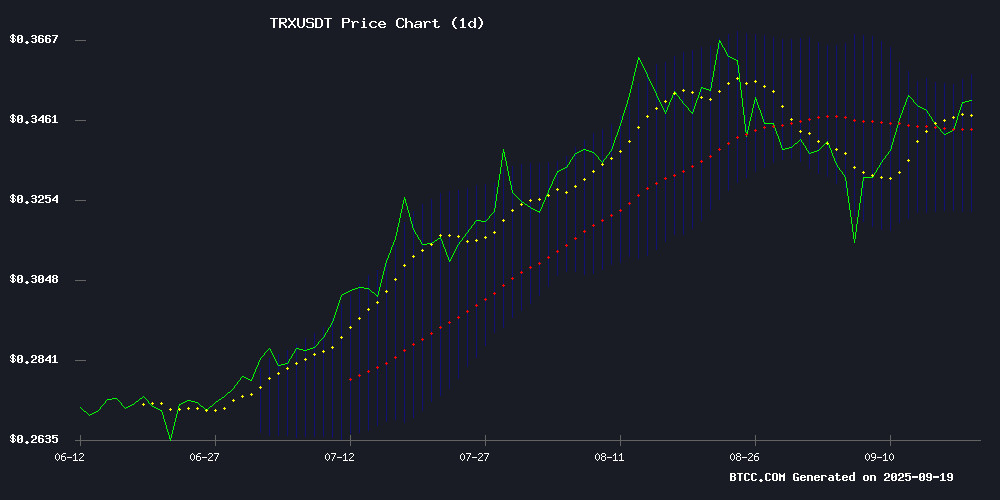

TRX is currently trading at $0.350000, comfortably above its 20-day moving average of $0.340060, indicating underlying strength. The MACD reading of -0.002453 suggests some near-term consolidation, though the positive signal line at 0.003132 hints at potential upward momentum. Trading within the Bollinger Bands range of $0.322402 to $0.357718 shows the asset is in a normal volatility environment. According to BTCC financial analyst William, 'The position above the 20-day MA combined with the MACD configuration suggests TRX may be preparing for a breakout above the upper Bollinger Band if bullish sentiment persists.'

Positive Market Sentiment Fueled by Strategic Partnerships and Ecosystem Expansion

The integration of PayPal's PYUSD stablecoin across nine additional blockchains through LayerZero, with TRON playing a key role in cross-chain capabilities via Stargate Hydra, represents significant fundamental strength. This development, coupled with the broader crypto futures surge led by major assets post-Fed rate cut, creates a favorable environment for TRX. BTCC financial analyst William notes, 'The LayerZero integration positions TRON at the forefront of cross-chain innovation, while the post-rate cut momentum provides tailwinds for the entire crypto sector. These developments support the technical bullish outlook for TRX.'

Factors Influencing TRX's Price

Top 10 Cryptos to Invest: The 2025 Meme Coin Revolution Unleashed

The meme coin phenomenon has evolved from internet jokes to serious market contenders, with projects like Ethereum (ETH), Solana (SOL), and Ripple (XRP) leading the charge. These digital assets, once dismissed as frivolous, now command significant trading volumes and investor attention.

A new entrant, BullZilla ($BZIL), is making waves with its dynamic presale model. The ERC-20 token features a pricing structure that adjusts every 48 hours or after each $100,000 milestone, creating urgency among early investors. This Shiba Inu alternative represents the next wave of meme coins blending community-driven narratives with sophisticated tokenomics.

The broader crypto market continues to see institutional interest in established projects like Binance Coin (BNB) and Cardano (ADA), while newer Layer 1 chains such as Sui (SUI) and Hyperliquid (HYPE) demonstrate the sector's ongoing innovation. Chainlink (LINK) maintains its position as the dominant oracle solution, underscoring the infrastructure needs of this expanding ecosystem.

PayPal's PYUSD Stablecoin Expands to Nine Additional Blockchains via LayerZero Integration

PayPal's dollar-pegged stablecoin PYUSD is extending its reach across the crypto ecosystem through a strategic integration with interoperability protocol LayerZero. The $1.3 billion asset will now be accessible on nine new chains including Aptos, Avalanche, and Tron—nearly tripling its native blockchain footprint beyond Ethereum, Solana, Arbitrum, and Stellar.

The technical implementation leverages LayerZero's Hydra Stargate system to create PYUSD0, a permissionless wrapper token that maintains 1:1 redeemability with the Paxos-issued original. This move accelerates PYUSD's bid to become a default dollar instrument in decentralized finance, capitalizing on LayerZero's cross-chain messaging dominance.

Supply metrics reveal striking adoption momentum, with PYUSD's circulating volume surging 150% year-to-date to $1.3 billion. The expansion targets liquidity fragmentation pain points across emerging ecosystems like Sei and Berachain, where community-issued versions will now convert seamlessly to the standardized wrapper.

TRON and LayerZero Enable Cross-Chain PYUSD Integration via Stargate Hydra

TRON DAO and LayerZero have launched PYUSD0 on the TRON network, marking a significant expansion of PayPal's stablecoin ecosystem. The integration uses the Omnichain Fungible Token standard to enable seamless cross-chain transfers without user intervention.

The Stargate Hydra bridge facilitates permissionless deployment of PYUSD0 while maintaining 1:1 dollar parity. This follows PYUSD's earlier deployments on Ethereum, Solana, and Arbitrum, positioning TRON as the latest blockchain to join PayPal's stablecoin infrastructure.

PayPal's move represents a strategic bridge between traditional finance and decentralized networks. The PYUSD0 implementation leverages TRON's high-speed, low-cost architecture to enhance global stablecoin accessibility for both institutional and retail users.

BNB, AVAX, and DOT Lead Crypto Futures Surge Post-Fed Rate Cut

Cryptocurrency markets extended gains following the Federal Reserve's interest-rate decision, with Binance Coin (BNB), Avalanche (AVAX), and Polkadot (DOT) spearheading derivatives activity. Futures open interest for the trio jumped 10% or more within 24 hours, amplifying their 5%-9% price appreciation.

Despite broad bullish momentum, analysts note underlying caution. "The Fed catalyst provided lift, but this isn't a clean rally," said Timothy Misir of BRN, pointing to mixed institutional flows and ETF outflows as signs of profit-taking. He identified $115,000-$115,500 as a critical Bitcoin price zone for risk management.

Notably, BTC's declining open interest in perpetual futures contrasts with its upward price trajectory—a divergence suggesting derivative traders remain sidelined. Meanwhile, ETH futures positioning on CME approaches 2 million ETH, signaling growing institutional engagement.

Is TRX a good investment?

Based on current technical indicators and market developments, TRX presents a compelling investment opportunity. The price trading above the 20-day moving average suggests underlying strength, while the strategic partnerships with LayerZero and PayPal's PYUSD expansion enhance its fundamental value proposition.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $0.350000 | Neutral/Bullish |

| 20-day MA | $0.340060 | Bullish (Price above MA) |

| MACD | -0.002453 | Watch for crossover |

| Bollinger Upper | $0.357718 | Resistance level |

| Bollinger Lower | $0.322402 | Support level |

The combination of technical positioning and positive ecosystem developments suggests TRX could see upward momentum, particularly if it breaks above the $0.357718 resistance level.